Jeff Koons’s Rabbit – Selling Air

Scene from the Christie’s New York Post-War and Contemporary Art auction held on May 15, 2019.

Scene from the Christie’s New York Post-War and Contemporary Art auction held on May 15, 2019.© Christie’s Images Limited 2019.

This time – the first time in quite a while – I would like to write about Jeff Koons. This column is about current events after all, and it was only recently that it was reported that in May, Koons’s sculpture Rabbit (1986) sold at Christie’s New York for 91.075 million dollars, breaking the record for a work by a living artist. (1) I don’t intend to go into detail about the price. I will only mention that converted into Japanese yen it was auctioned for around ten billion yen. In any case, it’s a figure well beyond the ken of the average individual.

There’s another reason why I wanted to write about Jeff Koons on this occasion. Which is that just the other day (May 29) I attended a preview in Shibuya of the movie The Price of Everything (2018) directed by Nathaniel Kahn, in which Jeff Koons, who symbolizes the current investment bubble in the art market, featured along with Larry Poons, a veteran painter who maintains that paintings and money are essentially unrelated. Rabbit (before it sold for a record ten billion yen, but arguably all the more valuably because of this) appeared repeatedly on screen as if it were a symbol of the former.

Scene from the filmThe Price of Everything in which Koons makes an appearance. The film opens at Eurospace in Shibuya and other theatres around Japan in August.

Scene from the filmThe Price of Everything in which Koons makes an appearance. The film opens at Eurospace in Shibuya and other theatres around Japan in August.

Rabbit appearing in The Price of Everything. Produced as an edition of three, plus one artist’s proof, the piece featured in the film is not the one that sold in auction; it belongs to art collectors Gael Neeson and Stefan Edlis, who also appear in the movie.

Rabbit appearing in The Price of Everything. Produced as an edition of three, plus one artist’s proof, the piece featured in the film is not the one that sold in auction; it belongs to art collectors Gael Neeson and Stefan Edlis, who also appear in the movie.

So for the remainder of this column I’d like to focus on this work called Rabbit. Of course, there are many other works representative of Koons’s oeuvre. But the topic at hand is not Koons himself, and almost all of the characteristics observable in these other works can also be seen in the early work Rabbit. As well, I have a particular attachment to Rabbit.

I think it was around 1987 that I first learned about Rabbit. In those days, I had the opportunity each month to be the first to view 35mm slides capturing the latest trends in New York. One of the terms I heard for the first time back then was “Neo-geo.” This was short for “neo-geometric conceptualism,” but around the same time Ryuichi Sakamoto put out an album titled Neo Geo (an abbreviation of “neo-geography”), perhaps in the sense of mixing up and redrawing musical maps all over the world, which gives a good indication of how sensitive New York-based Sakamoto was to the latest trends in the art world. Given this, it would have been foolish to clumsily substitute the term with Japanese. So it was around this time that I began to do some research into this “Neo-geo,” which was well known only to those in the know (though it would probably be more accurate to say that in Japan nobody knew about it). And it was in the course of this research that I came across Jeff Koons’s Rabbit.

However, Koons himself was not a typical example of a Neo-geo artist. Neo-geo was centered on painting, as represented by such artists as Ross Bleckner, Peter Halley, Philip Taaffe, and Peter Schuyff, and certainly the paintings by these artists represented the revival in conceptual terms of a geometric style that called to mind color field painting and Pop art. As well, in terms of journalistic newsworthiness, the title Neo-geo was clearly chosen to contrast with the Neo-expressionism that had created such a sensation in New York until just recently. It was precisely around this time that the New York art scene was witnessing the end of the period of isms based on competing stances regarding art and the transition to a “mode” period in which fashion was referenced and changes in art were regarded as a kind of fashion phenomenon. While there was none of the kind of dealing in art for huge sums of money that we see today, there were already adequate signs of a fundamental change in the meaning of art, from art as the crystallization of lofty ideas to art as the subject of financial investment whose value fluctuates according to the market. In fact, despite their appearances being totally different, Neo-expressionism and Neo-geo shared something in common, or rather they were connected at a fundamental level, on account of the prefix “neo-,” and they also enjoyed a synergy with the genre of Neo-pop to which the likes of Jeff Koons, Haim Steinbach and Ashley Bickerton were assigned, so that together they formed a paradoxical context that can only be called “Neo-ism.” This also formed the departure point in my first collection of critical essays, Simulationism: House Music and Appropriation Art (Yosensha, 1991).

Regarding this Neo-ism, in the sense that it was neo (newness) itself that was the objective, it was fundamentally different from Abstract Expressionism and Minimalism, which were already old hat. Neo-ism had nothing that was equivalent to the reality or insistence of Abstract Expressionism and Minimalism. The sole aim was to innovate (make new) the preceding fashion. Even the qualifier “contemporary,” indicating tense, disappeared from the term “contemporary art” with this process of “fashionization” necessary for its transformation into “art” as the object of investment alone. Isms negating the preceding thing are the first product of historical dialectics since Hegel, but while fashion may innovate a predecessor it never negates it. Because isms are products of the mind, once they collapse they are not easily restored, but in fashion, revivals occur as a matter of course (or rather, they occur of their own accord). Here, there are no hallmarks of the mind, only the appearance and reappearance of symbolized “things” that have no substance. Not even the maker can predict the destiny of these “things.” In short, everything has become the subject of manipulation and selection according to time and circumstances. Put simply, it is left up to the market. This is something that is much discussed, but essentially it is also where criticism began to decline.

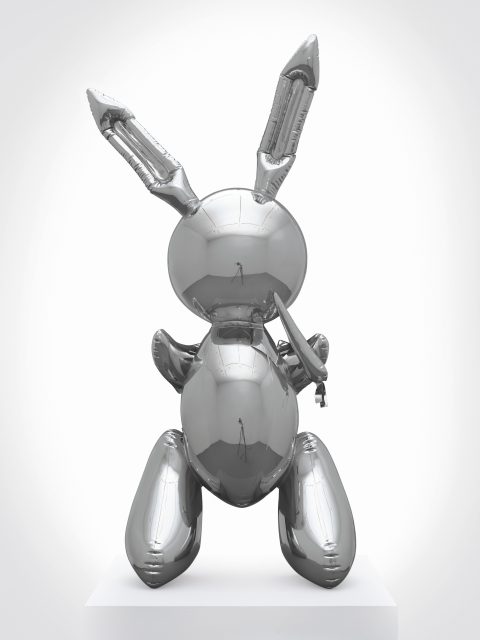

Jeff Koons – Rabbit (1986). © Christie’s Images Limited 2019.

Jeff Koons – Rabbit (1986). © Christie’s Images Limited 2019.

But back to Rabbit. As I recall, the first time Jeff Koons’s work was presented in the form of a solo show of any substance was at International With Monument, a small, privately owned gallery in the East Village. It was after showing at the long-established Sonnabend Gallery that Koons rose to prominence, but this history is relevant to our rabbit story. International With Monument was established by Meyer Vaisman, a young Venezuelan-born artist who was also involved in the Ne-geo movement. Vaisman was born in 1960, so he belongs to a slightly younger generation than Koons, who was born in 1955. He opened International With Monument for the purposes of actively providing opportunities to highlight new trends in art that were yet to attract attention. At the gallery, Vaisman set about planning solo exhibitions by the artists who would later be categorized under the name Neo-geo, namely Jeff Koons (1985, 86), Peter Halley (1985, 86) and Ashley Bickerton (1986).

Incidentally, an installation view at the Sonnabend Gallery when Rabbit was first displayed still exists. It shows that this group exhibition involved Jeff Koons, Ashley Bickerton, Peter Halley and Meyer Vaisman, and in fact carried on as is the context of International With Monument. And, sitting demurely on a white pedestal as if surrounded by the painterly works of the other three artists, is Rabbit, which in the 21st century would fetch the highest price at auction for a work by a living artist. Obviously, no one at the time could have predicted this.

Be that as it may, how did Rabbit come to be valued so highly? This above all else is probably the thing that everyone wants to know. As far as I know, until it was beaten by Koons, the record for the highest price paid at auction for a work by a living artist was held by David Hockney (around 9.9 billion yen). This is still a lot of money, but if we are talking about a painting, then it is rather more understandable. But Koons’s Rabbit is a rabbit made of stainless steel, not only that, but it is patterned on an inflatable balloon toy. Exactly what are we to make of the fact that this sold for ten billion yen? Before we discuss this, however, let us go over once again the fundamental principles of modern art. Yes, the matter is not quite that simple.

In thinking about what modernization actually means with respect to artworks, reference is often made to modern methods of settlement involving money. It goes without saying that money is important. It is indispensable. It is indispensable, but it would be a problem if its supply were unlimited. If it were unlimited, then everyone would be rich. It is precisely because there is a disparity of wealth that some people are rich. And for this reason, too, money cannot be unlimited. The way a limited amount of money is allocated determines whether one is rich or not. Even if products can be made by anyone, money, which is a medium for the exchange of these products and a means of obtaining what one wants, must not be something that anyone can make. Which is why in olden times money was made from precious metals (typically gold coins). There was even a time when it was made from gigantic stones. In any case, something rare. But with precious metals and gigantic stones, there was a crucial problem in using them as money as is. Because precious metals and gigantic stones were rare, it was impossible to reproduce them artificially, and so they could only be circulated to a limited extent in the largest amounts. But wasn’t it a good thing that money was limited? At the same time, however, the human population continued to grow, the production of commodities continued to grow in proportion, and the movement of people also became frequent. Gold coins, and even more so gigantic stones, are not the most convenient things to carry around all the time. It was at this point that the credit or trust economy emerged. I don’t have the gold coins on me now, but I certainly do have them and I can hand them over at a later date, so I will issue a bill of exchange for them now and for the time being can you give me the products I want in exchange? It came down to whether you trusted the other person or not. At this point it became something akin to gambling.

However, credit lacks the vital component of tangible form. Which is why bills of exchange were issued, although in the early days they were linked to precious metals. This was the financial conversion system. Bills of exchange could only be issued up to the value of the amount of gold the person owned. However, because at the beginning credit had no form, even if the bills were linked to gold, it was not certain whether the person owned the corresponding amount of actual gold or not. In other words, the crucial thing is that already at this point trust had become more important than actual gold. To put it another way, as long as their credit wasn’t shaken, people would hand over any amount of products to that person (which is exactly the case with “credit” cards). Or to put it another way still, as long as things were trusted and secured, not only was there no need for money to take the form of precious metals or gigantic stones, but it could even be substituted with paper (bills of exchange). In fact, this is the fundamental principle of the modern paper money system, and the thing that gives credit to that paper is the security that it is issued by states. Paper money issued by strong states also has great value in terms of foreign exchange, while paper money issued by unstable states has no exchange value on the international market. What determines this relative strength and weakness is so-called “national strength,” which includes political, economic and military strength, and in fact this itself is unstable. However, credit is something that is essentially unstable, so for the time being it is inevitable that paper money value will lean towards strong states. What is important is that here, economic value is determined not by things with actual value such as precious metals but by intangible credit transactions.

I’ve commented at length on economic matters, but one can also think about the modernization of artworks along more or less similar lines. Valuables and other so-called “treasures” are pre-modern things. Because their value depends largely on the scarcity of the raw materials that comprise the things themselves (an example that is both commonplace and typical being diamonds). However, regardless of how high they are piled up, banknotes themselves have no value as raw material. In terms of their cost price, they are merely pieces of paper with ink daubed on them. It is due to credit provided by the state (in the case of a ten thousand yen note, for example, the state guarantees that if you allow a person who comes to you with this banknote to buy something to the value of ten thousand yen you will not lose) that economic exchange value corresponding to the total amount arises.

In reality, modern painting, too, is exactly the same as this. Why do paintings by the likes of Monet, Cezanne, Picasso and Matisse have such enormous economic (exchange) value? Aren’t they nothing but canvases on which paint has been daubed? Unlike the treasures of olden times, they are not covered in gold leaf. Neither are they encrusted with precious stones (in this sense, Nihonga, whose value is determined by the scarcity and amount of the raw materials, still retain vestiges of painting’s pre-modern era). The thing that gives these pieces of canvas daubed with paint values of hundreds of millions, billions or tens of billions of yen is credit. In other words, the next time they put them on the market, the owners of these paintings can exercise the corresponding exchange value (in fact, due to their investment value, there is a likelihood that this amount will have increased).

At this point, however, doubts surface. The thing that gives banknotes their value is credit provided by the state. So what is it that maintains the corresponding economic value of paintings by Picasso or Matisse? The answer is the credit of art historical value. Because the power exercised by the painting concerned has been established by authoritative research, studies and criticism within art history, a development of human wisdom, its scarcity has been granted in advance in the form of economic credit.

Among the first to realize this was Marcel Duchamp. If the value of an artwork lay not in its substance but in its credit, then as long as it was given credit its substance could be anything. In fact, while the value of modern painting isn’t questioned because it receives credit, in essence it is cheap as it consists only of canvas on which paint has been daubed. So something cheap turns into something expensive as a result of credit. If this alchemy is the core of modern art, then for the purposes of clarifying this mechanism, it is best if something that seems to have as little value as possible is converted into credit. A painting surrounded by a fancy frame or a massive sculpture would make us forget this. In which case, what could be better than a urinal? It is not respected by anyone, rather it is regarded as dirty. Moreover, it is something that can be bought easily by anyone at a store in town. If one were able to simply sign such a “worthless” urinal and display it in an art museum, surely people could see through the very mechanism of modern art whereby cheap things are converted into expensive things. Duchamp’s scheme ended in failure as art museums refused to display the urinal, but today, some 100 years later, this art historical credit has become something for which the sky is the limit.

Jeff Koons’s Rabbit is essentially an extension of this. If he were following in the footsteps of Duchamp, in order to see through the mechanism of modern art, it would be best to choose something as worthless as possible, something that seemed to have no meaning. What Koons chose was an inflatable toy balloon in the shape of a rabbit. With mere readymades, there is a limit to the amount of credit. Such an approach is already well-worn and commonplace. Koons chose to make a mold from a balloon rabbit and cast it in stainless steel, finishing the surface to give it a mirror-like appearance. The important points here are as follows. First, though it was cast in stainless steel, in terms of its impression it is essentially no different from the original balloon rabbit. Evidence of this includes the fact that even the wrinkles created by the Mylar expanding are faithfully recreated. The raw material used in the balloon rabbit is polyester film, but the contents are nothing but air. Irrespective of the extent to which the contents fill the cast Rabbit, there is no change in the fact that the motif is air. In other words, in both cases the subject being addressed is air.

Incidentally, air has no economic value. Special air may be worth something, but the thing Koons chose as his motif is the air that can be used to fill something with the mouth. This kind of thing has no value. Even a urinal probably had some kind of value, but the air we all breathe to stay alive (and occasionally use to blow up balloon rabbits) has no value whatsoever. If one could succeed in affixing economic value to something with no value by turning it into an artwork, then it would amount to achieving with even greater precision what Duchamp attempted to do (incidentally, Koons often uses things such as basketballs, aqualungs and boats that have air as one of their raw material). Aren’t these exactly like art, in that they consist of “fine” bubbles? Because despite the fact that they are sold for an extraordinarily high price, in the final analysis bubbles are just air.

The second important point is that in the face of the rabbit with its mirror-like surface, the faces of the viewers are reflected. In other words, Rabbit reflects the very reactions (expressions) of the people viewing the work. Accordingly, it is difficult to photograph Rabbit. Photographing it entails placing a camera in front of it, but inevitably the camera is reflected in the surface. However, this is something that is difficult to avoid (as can be seen in the photographs accompanying this column, even when first displayed at the Sonnabend Gallery, it is possible to see reflected in Rabbit‘s face the figure of a photographer in a black cloak hiding behind the stand on which the camera has been placed). As well, there would probably be a decisive difference between the faces reflected in it when it was displayed as the work of an obscure young artist and the faces reflected in it now when it has recorded a market value of ten billion yen (assuming one actually had the chance to view Rabbit). In other words, these mirror images are themselves a part of Rabbit. No doubt Rabbit will continue to transform the faces of the people reflected in it in the future, the change becoming even more obvious as the size of the alchemic leap of modern and contemporary art that converts valuelessness into value itself increases. In this sense, with a “human = rabbit face” as a kind of insert, Rabbit sculpts the trust and uncertainty of credit down through the ages as well as the very passage of this time.

In light of the above, might it be possible to regard Rabbit as the quintessence of modern art? In addition, unlike the modern system of paper money, the value of artworks is not specified. On banknotes, a set amount, whether it be one thousand yen or ten thousand yen or some other amount, is printed, and they cannot be used beyond that. However, if the credit of artworks only increases, then their economic value will also keep on increasing at a corresponding rate. And because they originally have no value, there is no limit to this increase. At an auction, if two or more people identify themselves as interested in an object up for sale, unless they both pull out at the same time, the price will keep on rising. This has turned into the ultimate medium for purely reflecting/assimilating human avarice. Jeff Koons’s Rabbit is a historical monument to this (but a monument whose medium is a mirror surface devoid of depth and whose motif is worthless air).

1. “Jeff Koons’s record-breaking Rabbit shines bright in New York,” Christie’s website, 17 May, 2019.